3/30/ · MW are patterns that happen every single week on some pairs as cylce price movement always behave the same way. Going up and down If we look at it closely, it forms letters M & W drawn on chart. M formation could generate a reversal set up => Bearish; W formation could generate a reversal set up => Bullish Quasimodo Pattern is also called as OVER & UNDER Pattern. It is a reversal pattern that is created after a significant obvious trend. When a series of higher high, higher low, or lower high lower low is interrupted, Quasimodo Pattern is created. It is a double-ended cheater strategy 9/26/ · This is a very popular pattern to signal trend reversal. Prices in an uptrend rally to a point and correct, forming a left shoulder. Price rallies again to a higher high continuing the uptrend

Trading Patterns

Moments after entering into the market and you are already experiencing a massive return, stops are placed at break even and you can relax for the day knowing you are no longer at any risk of loss. This is how it feels to take a Forexia style reversal trade off the highs or lows. How many times have you bought into a breakout of the highs only to see the market instantly reverse w forex pattern you?

Almost like the market knows exactly when you are entering and does the exact opposite just to piss you off. Before I started to trade, I studied human psychology and neuro-linguistic programming. My understanding of human psychology helped me achieve my breakthrough in trading.

You see, as humans, we are always given multiple options. What matters is you are playing their game with rules they created FOR YOU. We see the obvious Asian session consolidation depicted in the pink boxes, w forex pattern, the next session is London session which we know as the induction or breakout session.

Each day there is a new high and low that is created. These patterns occur on all scales and on all timeframes. The timeframe above is the 15m, here we can clearly see the structure of the different sessions that occur on a daily basis. The breakout traders are induced to buy or sell in the direction of the breakout, shortly after the market will reverse and hit the stops of the dumb money, w forex pattern.

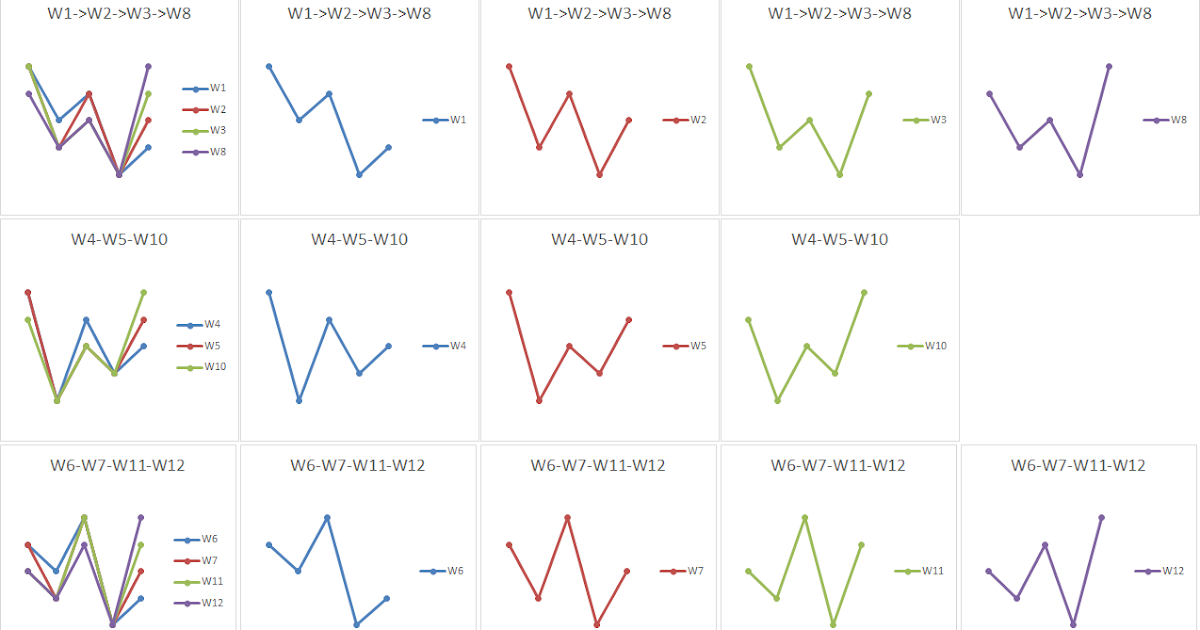

The best sessions to trade are London Session and New York Session, w forex pattern. These sessions will present the best reversal setups. Asian session should be avoided as there is very little movement. Above we can see another great example, this time of the New York session reversal setup after an extended period of Asian consolidation. This is a universal guide to trading M and W formations on any pair in Forex. This works on all timeframes under the daily timeframe.

We recommend backtesting everything we have highlighted in this post for greater clarity of the power you are tapping into! Asian session consolidation normally consists of price ranging back and forth in the same zone for an extended period of time.

This consolidation period can range from 8 to 15 hours. Trying to trade M and W formations inside of this consolidation is a huge no-no! The M and W pattern is the most lucrative trading strategy that exists. The W pattern is very simple to understand when you can put w forex pattern confirmations together. A valid W pattern is found only at the low of the day during either London or New York session.

The Asian session is known as the consolidation session which traps traders who use support and resistance to trade. After creating a clear consolidation range, the price will then break out of this consolidation. After the majority of the masses have committed the dealer then moves in the opposite direction of the breakout trapping those w forex pattern have already committed into the direction of the breakout.

Asian session consolidation is used as the comfort zone in which retail traders mark up support and resistance, w forex pattern.

In the example above we see the London session breakout to the downside causing retail to sell, then New York session reverses the market against the dumb money sellers induced London session.

The M pattern is the exact same as the W pattern with the only exception being all the rules are inverse, w forex pattern. A valid M formation is only found at the high of the day after Asian session. The breakout in this case is also extremely necessary to induce the masses in the wrong direction. The masses may be dumb, but they are not that dumb.

They will always continue to look for confirmation in order to validate their trades. So, we must understand the reverse psychology behind why the M and W pattern is such an effective reversal strategy.

The confirmation that the masses use to determine a trend is the creation of higher highs and higher lows in the case of an uptrend. In the case of a downtrend, the masses look for lower highs and lower lows to make their confirmation. The neckline of the M or W pattern will always be where the lower high or higher low is formed. Above we can see that after the neckline lower high has been created there is a volatile move past the low and a lower low is created.

The goal is to get a zero drawdown entry by taking our trade off the exact high of the day. M or W pattern trading is otherwise called the double top or double bottom, w forex pattern. We have an entire world of confirmations that are used in conjunction with validating an M or W setup. Above we can see 8 w forex pattern confirmations for this single trade. This is a perfect example of the zero drawdown strategy put into action with multiple confirmations to back up your thesis.

The next time you analyze the for M or W formations be sure to take these confirmations into mind and remember the more confirmations the better. Below is a list of all the confirmations seen in the screenshot above. Now we have a clear vision of why the market did what it did, w forex pattern. Clearly a reversal was pending and we just connected the dots by stacking confirmation on confirmation. Many more confirmations exist to help you to validate the trade.

In our next blog post we overview the many different confirmations that exist. Above is a w forex pattern that could be framed and hung on a wall in my bedroom to be looked at and admired for a lifetime.

Our SignatureTrade weekly reversal structure is my personal favorite setup. The risk vs reward potential on these setups far surpasses any other type of M or W trade formations. What makes our SignatureTrade different from other M and W formations is the wedge pattern located in the middle of w forex pattern structure and also the many confirmations that we use to validate the pattern.

In our next blog post, we overview the many different confirmations that exist. Save my name, email, and website in this browser for the next time I comment.

Sign up to our newsletter! Follow Me! Username or Email Address, w forex pattern. Remember W forex pattern. Subscribe Now. Trending W forex pattern. How to trade M and W Patterns Zero Drawdown Strategy 1 year ago 9 min read. USDCHF — Before analysis 1 year ago 1 min read. Blog Post, w forex pattern. Educational Content.

Dylan Shilts1 year ago 1 9 min read Tags double top forex reversal pattern m and w pattern market manipulation reversal forex the w pattern trading m and w formations trading m and w pattern.

Dylan Shilts. Related posts. Backtesting is your only hope at success. W forex pattern Shilts1 year ago 2 min read. The Virtuous Trader Elwin Coleman12 months ago 3 min read.

Forex Perfect Entry Timing Strategy Dylan W forex pattern11 months ago 2 min read. The Psychological Trader Elwin Coleman1 year ago 4 min read.

Forex Mid-Week Reversal — Fact or Fiction? Dylan Shilts1 year ago 3 min read. USDCAD — Before Live Analysis — Forexia Blog […] Additionally, the price might go downside first and consolidate on Tuesday make Tuesday or Mid Week reversal. Recent Posts. How to trade M and W Patterns Zero Drawdown Strategy 1 EURAUD — Before Live Analysis 0 USDCHF — Before Live Analysis 0 Login Register. Username or Email Address Password Forgot Password Remember Me.

Registration is closed. W forex pattern English.

Understanding Chart Patterns for Online Trading

, time: 15:58Double Top and Bottom Definition

The ''M'' and ''W'' trading pattern is a great little pattern that occurs with enough frequency for you to add it to your trading tool bag. It is very similar to a triple top or triple bottom - but unlike the triple top or bottom we are trying to enter the market on the bottom of the leg on the ''M'' pattern and the top of the leg on the ''W'' pattern 2/26/ · The W pattern is very simple to understand when you can put the confirmations together. A valid W pattern is found only at the low of the day during either London or New York session. The Asian session is known as the consolidation session which traps traders who Quasimodo Pattern is also called as OVER & UNDER Pattern. It is a reversal pattern that is created after a significant obvious trend. When a series of higher high, higher low, or lower high lower low is interrupted, Quasimodo Pattern is created. It is a double-ended cheater strategy

No comments:

Post a Comment