Positive Correlation of Currency Pairs. A positive correlation is a relationship between two currency pairs in which both pairs move in tandem. We can see the positive correlation between the demand for the product and its price, the price increases when the demand for the product increases. Similarly, in the forex market, currency pairs 4. · There is a positive correlation when two pairs move in the same direction, a negative correlation when they move in opposite directions, and no correlation if the pairs move randomly with no detectable relationship · (4) and below are for 2 pairs X and Y, but if you do 3 pairs X, Y, and Z its similar just a bit more complicated 4) Run a linear regression of each pair against all other pairs to calculate the trading coefficient. Side note: For 2 pairs, I run principal component analysis so the coefficients are reciprocals of each other

Correlation between Currency Pairs – Your Trade Mentor

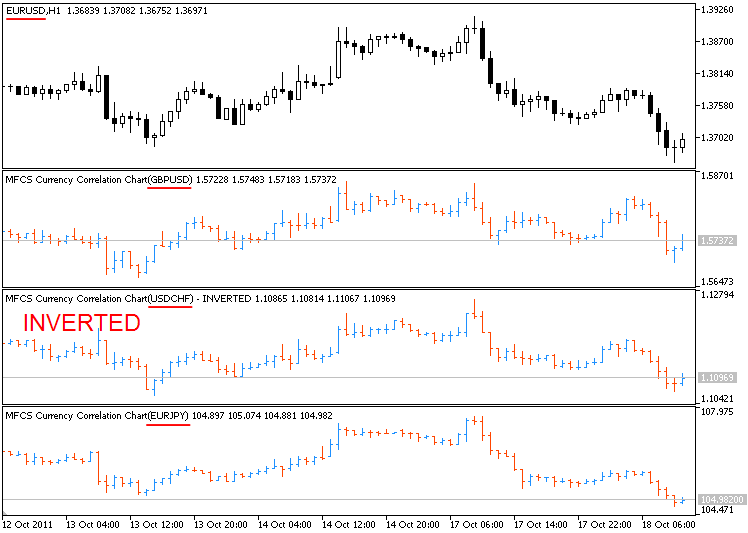

In the forex there are pairs which correlate, meaning there is a relationship between separate pairs of currency. Such correlation between currency pairs can either be a positive or a negative one. A positive correlation between pairs is that both currencies will move alongside each other. So if one currency moves, the other one will move in the same direction. On the other hand, you have negative correlating pairs, which is exactly the opposite of a positive correlation. So instead of moving along side each other, they move in opposite directions.

So how is this measured? For the measurement of correlation, forex relationship between pairs, we use the correlation coefficient. This is the statistical measurement of the strength of correlation between currency pairs. The range of the measurement is between forex relationship between pairs and So if the relationship between two pairs is strong it will come close to 1, if they move opposite from each other it will get towards Thus, if a pair is moving perfectly in synchrony it will be a coefficient of 1 and if it moves exactly the opposite it will be Therefore, if a pair has no relationship it will be a coefficient of 0.

This is an example of a pair with a strong correlation. The Geographical location, economic relationship and strength of the currency, are all factors which cause these correlations to exist. Within the forex you are able to use these correlating pairs with different purposes while trading.

You can either use such pairs in order to increase your profit by opening two positions on a positive correlating pair. So in this case you can benefit of the positive relationship between the two currencies.

On the other hand, you can use negative correlating pairs to hedge your risk. By doing so you can open two positions with two currencies which have a negative coefficient. This is a way to minimize losses, since they will move opposite from each other. But keep in mind that this is not always correct, consequently there is always a chance that it will not go as predicted.

In this case you are more vulnerable for even bigger losses, forex relationship between pairs. Your forex relationship between pairs address will not be published.

Training Videos. Home Blog Blog Correlation between Currency Pairs. You might have heard of correlating currency pairs, but what does it mean? The Correlation coefficient. So how forex relationship between pairs there are some correlation between pairs?

Trade with correlating pairs, forex relationship between pairs. Previous post The Power of Compounding July 12, The Power of Compounding 5 July, forex relationship between pairs, How to win big on the Forex markets 8 June, The Pros and Cons of Trading with EAs 1 June, Juicer Reviews.

Leave A Reply Cancel reply Your email address will not be published.

Using Correlation in Forex Trading by Adam Khoo

, time: 15:50Best Forex Correlation Pairs Strategy With Fx Currency Pair Correlation

· (4) and below are for 2 pairs X and Y, but if you do 3 pairs X, Y, and Z its similar just a bit more complicated 4) Run a linear regression of each pair against all other pairs to calculate the trading coefficient. Side note: For 2 pairs, I run principal component analysis so the coefficients are reciprocals of each other Positive Correlation of Currency Pairs. A positive correlation is a relationship between two currency pairs in which both pairs move in tandem. We can see the positive correlation between the demand for the product and its price, the price increases when the demand for the product increases. Similarly, in the forex market, currency pairs 4. · There is a positive correlation when two pairs move in the same direction, a negative correlation when they move in opposite directions, and no correlation if the pairs move randomly with no detectable relationship

No comments:

Post a Comment